Reportlinker Adds Food Safety Products in China: Industry Study with Forecasts for 2013 & 2018 Report

NEW YORK, Oct. 1 /PRNewswire/ — Reportlinker.com announces that a new market research report is available in its catalogue.

Food Safety Products in China: Industry Study with Forecasts for 2013 & 2018

Abstract:

Growth will be driven by the continuing expansion of processed food and beverage output, and a greater focus on food safety and supply chain security by larger food processing firms.

Executive Summary:

Demand to increase 15% annually through 2013

Demand for food safety products in China is forecast to increase 15 percent per annum through 2013 to ¥13.0 billion. Growth will be driven by the continuing expansion of food and beverage output, mainly in the processed food, beverage and dairy product segments that are more intensive users of these products. A greater focus on food safety and supply chain security by larger food processing firms in China will also boost gains. This will be partly in response to enhanced government regulation, in particular the Food Safety Law introduced in 2009. Consumer concerns in both domestic and export food markets following a series of food safety scares involving Chinese food will also prompt spending on food safety products by food industry participants. Enhancing responsibility and food safety awareness in China will be crucial for ensuring the sustainability of future gains in the food safety products industry. However, there remain doubts as to the effectiveness of the local implementation of the new Food Safety Law.

Tracking products to exhibit strongest growth

Disinfection products will remain the largest food safety product category. Gains will be driven by a greater use of disinfectants and sanitizers in food processing plants, as well as by fast growing demand for pasteurization equipment by dairy and beverage firms in China. Strong advances in sales of diagnostic testing products will be driven by the increasing numbers of food processor and government agency tests for pathogenic and non-pathogenic contaminants. The strongest gains will be in the tracking product segment, with demand for RFID and other smart labels and tags, as well as tracking software systems, benefiting from concerns over supply chain security. Increases in the preservatives segment will lag overall gains to some extent, largely due to the more mature nature of this product segment. However, annual demand growth of almost 13 percent will be fueled by increases in processed food and beverage output, as well as by price gains for preservatives.

Food processing plants to remain largest market

Food processing plants are the largest market for food safety products in China, accounting for 85 percent of sales in 2008. Such dominance is due to relatively strong government oversight of these facilities and the high profile of these firms among consumers. The next largest category is government purchases, as tens of thousands of inspections are carried out around the country each year by local government agencies. The demand level for food safety products by foodservice establishments, wholesale and distribution operations, retail and agricultural units is limited by low food safety awareness, low income levels and a lack of incentives to boost spending.

TABLE OF CONTENTS

INTRODUCTION ix

I. EXECUTIVE SUMMARY 1

II. MARKET ENVIRONMENT 4

General 4

Economic Overview 6

Recent Economic Performance 6

Economic Outlook 10

Demographic Overview 13

Population Trends 13

Households 16

Industrialization & Manufacturing Trends 17

Currency Exchange 20

Personal Income & Expenditure Trends 23

Agriculture Overview 26

Historical Perspective 27

Recent Developments & Policy Outlook 29

Agricultural Output Trends 33

Crops & Planted Produce 35

Animal Husbandry 37

Meat & Poultry 38

Raw Milk 40

Fish & Seafood 42

Food & Beverage Industry Outlook 43

Meat & Seafood 46

Processed Food 47

Beverages 49

Dairy Products 51

Other Food 54

Food Trade 55

Imports 57

Exports 58

Food Supply Chain Trends 59

Agricultural Production & Commodity Distribution 61

Food Processing & Wholesale Distribution 63

Retail Distribution & Foodservice Establishments 65

Consumer Food & Beverage Expenditures 66

Historical Market Trends 67

Food Safety Incidents & Food Related Illness Trends 69

Regulatory Issues 71

International Activity & Foreign Trade 76

III. TECHNOLOGY OVERVIEW 79

General 79

Disinfection 81

Diagnostics 84

Tracking Products 87

Other 90

IV. PRODUCTS 92

General 92

Disinfection Products 94

Disinfectants & Sanitizers 96

Chlorinated 98

Iodophor 100

Other Disinfectants & Sanitizers 102

Disinfection Equipment 105

Pasteurization 108

Other 111

Other Disinfection Products 113

Preservatives 114

Biocides 117

Antioxidants 119

Diagnostic Testing Products 121

Pathogens 126

General 128

Pathogen-Specific 129

Residue 130

Other Diagnostic Testing Products 132

Tracking Products 135

Software & Tracking Systems 137

Smart Labels & Tags 139

Bar Codes 141

RFID Tags 142

Smart Labels 143

Other 144

V. MARKETS 147

General 147

Food Processing Plants 150

Beverages 153

Processed Food 155

Meat & Seafood 157

Dairy Products 159

Other 161

Government 163

Foodservice Establishments 164

Retail, Wholesale & Distribution 166

Agriculture 168

VI. INDUSTRY STRUCTURE 170

General 170

Industry Composition 171

Market Share 174

Ningbo Wanglong Group 175

Wuhan Youji Industrial 175

Zhejiang Silver-Elephant Bio-engineering 176

Tetra Laval 176

Competitive Strategies 176

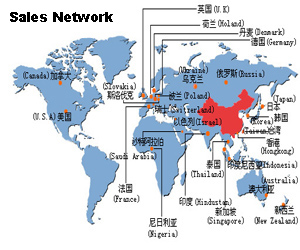

Marketing & Distribution 178

Cooperative Agreements 179

Foreign Participation in China 180

Legal & Regulatory Issues 180

Joint Ventures 182

Wholly-Owned Foreign Enterprises 184

Representative Offices 185

Company Profiles 186

ALLTEC GmbH, see Danaher Corporation

Applied Biosystems, see Life Technologies Corporation

APV, see SPX Corporation

Beijing Bobang Food Additives Company Limited 187

Beijing Liujiaoti Science and Technology Development

Company Limited 188

Butcher Company, see JohnsonDiversey Holdings

CDC Corporation Limited 189

ChinaTrace, see TraceTracker Innovation ASA

Danaher Corporation 192

Danisco A/S 195

EBI Food Safety 198

Ecolab Incorporated 199

GEA Group AG 203

Guangzhou Taibang Food Additive Company Limited 205

Guangzhou YouBao Biotech Company Limited 206

Hach Company, see Danaher Corporation

HuaYue Enterprise Holdings Limited 207

Hygiena 208

InfinityQS International Incorporated 210

ITT Corporation 211

JohnsonDiversey Holdings Incorporated 213

Johnson Wax Professional, see JohnsonDiversey Holdings

Life Technologies Corporation 215

Linkwell Corporation 217

Nanjing Gaojie Light Industrial Equipment Company

Limited 219

Nanjing Lehui Light Industry Equipment Manufacturing

Company Limited 220

Ningbo Leying Professional Kitchen Equipment,

see Nanjing Lehui Light Industry Equipment

Manufacturing

Ningbo Retort Sterilization Equipments,

see Nanjing Lehui Light Industry Equipment

Manufacturing

Ningbo Wanglong Group Company Limited 221

R-Biopharm AG 222

Ross Enterprise Incorporated, see CDC Corporation

Shandong Institute of Standardization, see TraceTracker

Innovation ASA

Shandong Lircon Disinfection Science Technology

Company 224

Shanghai Light Industry Machinery Company Limited 225

Shanghai LiKang Disinfectant High-Tech Company,

see Linkwell Corporation

Shanghai Zhujing Chemical Factory 226

SONTEC Global Limited 227

SPX Corporation 228

Tetra Laval International SA 231

Tetra Pak International, see Tetra Laval International

Thermo Fisher Scientific Incorporated 233

3M Company 235

Tianjin Jiuding Medical Bioengineering Company Limited 239

TraceTracker Innovation ASA 240

Trojan Technologies, see Danaher Corporation

Tuchenhagen Flow Components China, see GEA Group

UPM-Kymmene Corporation 241

US Chemical, see JohnsonDiversey Holdings

Videojet Technologies, see Danaher Corporation

Waters Corporation 243

Waukesha Cherry-Burrell, see SPX Corporation

WEDECO AG, see ITT Corporation

Wuhan Youji Industrial Company Limited 245

Zhejiang Silver-Elephant Bio-engineering Company 246

Zhuhai Joinet Bar Code Auto-identity System Limited 247

Other Companies Mentioned in the Study 249

LIST OF TABLES

SECTION I — EXECUTIVE SUMMARY

Summary Table 3

SECTION II — MARKET ENVIRONMENT

1 Gross Domestic Product of China 12

2 Population of China 15

3 Households in China by Region 17

4 Manufacturing Value-Added in China 19

5 Chinese Currency Exchange Rates, 1998-2008 22

6 Personal Income & Expenditures in China 26

7 Agricultural Output in China 35

8 Selected Crop & Planted Produce Output in China 36

9 Animal Husbandry in China 38

10 Fish & Seafood Output in China 43

11 Food & Beverage Production in China 45

12 Meat & Seafood Production in China 47

13 Processed Food Production in China 49

14 Beverage Production in China 51

15 Dairy Product Production in China 53

16 Other Food Production in China 55

17 Food & Beverage Supply & Demand in China 57

18 Food Imports to China 58

19 Food Exports from China 59

20 Consumer Food & Beverage Expenditures in China 67

21 Food Safety Product Market in China, 1998-2008 68

SECTION IV — PRODUCTS

1 Food Safety Product Demand in China by Type 93

2 Disinfection Product Demand in China 95

3 Disinfectant & Sanitizer Demand in China 98

4 Chlorinated Disinfectant & Sanitizer Demand in China 100

5 Iodophor Disinfectant Demand in China 102

6 Other Disinfectant & Sanitizer Demand in China 105

7 Disinfection Equipment Demand in China 107

8 Other Disinfection Product Demand in China 114

9 Food & Beverage Preservative Demand in China 117

10 Biocide Preservative Demand in China 119

11 Antioxidant Preservative Demand in China 121

12 Diagnostic Testing Product Demand in China 126

13 Pathogen Diagnostic Testing Product Demand in China 128

14 Residue Diagnostic Testing Product Demand in China 132

15 Other Diagnostic Testing Product Demand in China 135

16 Tracking Product Demand in China 137

17 Software & Tracking System Demand in China 139

18 Smart Label & Tag Demand in China 141

19 Other Food Safety Product Demand in China 146

SECTION V — MARKETS

1 Food Safety Markets in China 149

2 Food Processing Plant Market for Food Safety Products

in China 152

3 Beverage Processing Market for Food Safety Products

in China 155

4 Processed Food Processing Plant Market for Food Safety

Products in China 157

5 Meat & Seafood Processing Market for Food Safety Products

in China 159

6 Dairy Product Processing Market for Food Safety Products

in China 161

7 Other Food Processing Markets for Food Safety Products

in China 162

8 Government Market for Food Safety Products in China 164

9 Foodservice Market for Food Safety Products in China 166

10 Retail, Wholesale & Distribution Market for Food Safety

Products in China 168

11 Agricultural Market for Food Safety Products in China 169

SECTION VI — INDUSTRY STRUCTURE

1 Revenue Data: Selected Food Safety Product Companies,

2008 173

LIST OF CHARTS

SECTION II — MARKET ENVIRONMENT

1 Population of China by Age, 1998-2018 16

2 Chinese Currency Exchange Rates, 1998-2008 23

3 Food Safety Product Market in China, 1998-2008 69

SECTION IV — PRODUCTS

1 Food Safety Product Demand in China by Type, 2008 94

SECTION V — MARKETS

1 Food Safety Markets in China, 2008 149

2 Food Processing Plant Market for Food Safety Products

in China, 2008 153

SECTION VI — INDUSTRY STRUCTURE

1 Food Safety Product Market Share in China by Company, 2008 175

To order this report:

Food Safety Products in China: Industry Study with Forecasts for 2013 & 2018

http://www.reportlinker.com/p0135785/Food-Safety-Products-in-China-Industry-Study-with-Forecasts-for-2013–2018.html

More market research reports here!

Nicolas Bombourg

Reportlinker

Email: nbo@reportlinker.com (805)652-2626

US:

Intl: +1 805-652-2626

SOURCE Reportlinker

Leave your response!